Depok-Financial technology (fintech) is an innovation in the financial services industry that utilizes technology and has an impact on financial stability. Fintech was created to make financial services faster, easier, safer, and more affordable. For example, such as ATMs, mobile banking, digital payments, and robo-advisors. In Indonesia, the development of fintech began with the presence of Bank Niaga ATMs in 1987. Then, followed by e-banking services by Bank Internasional Indonesia (BII, now known as Maybank Indonesia). Not only that, Bank Central Asia (BCA) expanded its e-banking services through KlikBCA in 2001 and became the starting point for the development of fintech in Indonesia.

Creative Business study program, Vocational Education Program, Universitas Indonesia (UI), presents Gelar Pradipta Utama—or often called Gege—, Ex-Head of Product JoinedApp (Silicon Valley Company), Rukita, and Emtek Digital, as a guest lecturer to introduce the world of fintech and its benefits to students. According to him, there are several factors that accelerate the use of fintech in society, namely the increase in digital payments, regulatory changes, and technological developments.

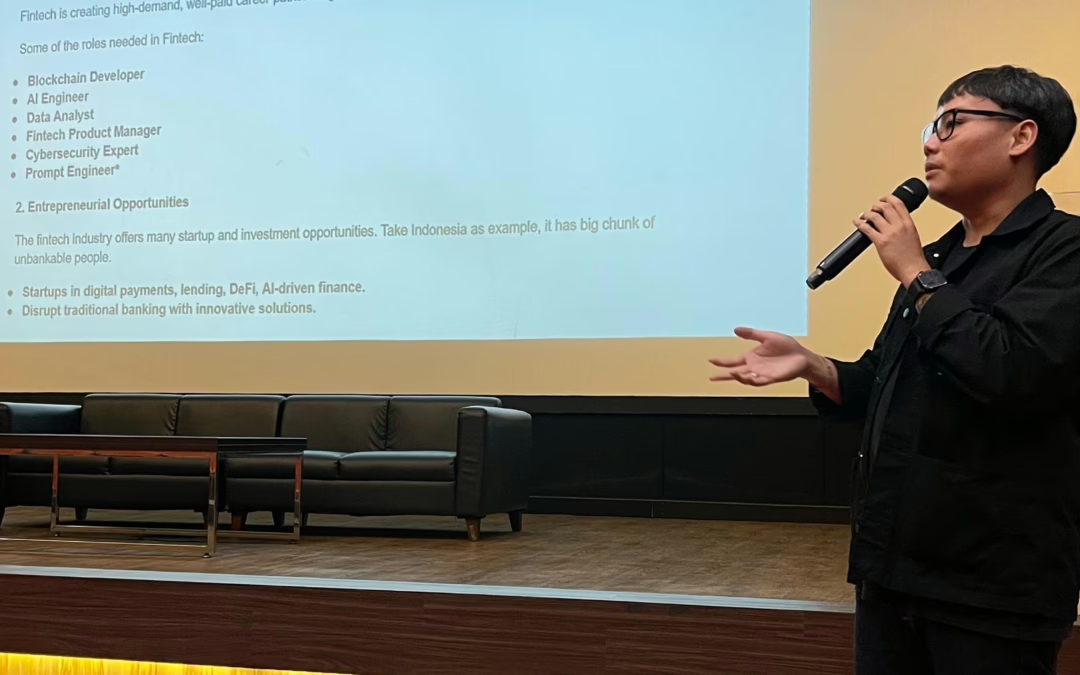

(Photo: Gege explains the concept of blockchain and its impact on fintech)

(Photo: Gege explains the concept of blockchain and its impact on fintech)

Gege also revealed several technologies that support the use of fintech. For example, blockchain which is a decentralized digital ledger and records transactions securely, transparently and permanently on various computers. “Blockchain technology will eliminate intermediaries, and make financial services faster and more efficient. In addition, another technology is Decentralized Finance (DeFi) which also makes financial services more transparent and affordable. DeFi uses blockchain to enable direct transactions,” explained Gege.

On that occasion, Gege also introduced the use of artificial intelligence (AI) in fintech. For example, chatbots launched by Indonesian banks, such as MITA owned by Bank Mandiri or BRINA owned by Bank Rakyat Indonesia (BRI). The use of AI will increase security and reduce financial risks, such as detecting fraud from suspicious transactions or risk assessments based on customer creditworthiness.

Gege added that there are several opportunities that arise thanks to the presence of fintech, such as jobs in the fintech world. For example, Blockchain Developer, AI Engineer, Data Analyst, Fintech Product Manager, Cybersecurity Expert, to Prompt Engineer. Not to forget, the fintech industry also offers opportunities to start a business and investment.

(Photo: Group photo after the guest lecture ended)

(Photo: Group photo after the guest lecture ended)

Gege explained some upcoming trends in the fintech world. “We need to study digital financial services that will facilitate various transactions. In the future, several technologies such as AI-Driven Finance will make financial services more efficient and secure through smarter automation, predicting risks, and preventing fraud. Then, the implementation of Central Bank Digital Currencies (CBDCs) can be used by the government to modernize finance and replace cash. Finally, quantum computing can process super-fast data for financial analysis and security,” Gege explained.

Director of UI Vocational Education Program, Padang Wicaksono, S.E., Ph.D, said that the development of the fintech world needs to be recognized and utilized by students as an impact of technological progress today. “Through the teachings given by practitioners in the industrial world, I hope that students can make the most of this moment. So that in the future, graduates of the Financial Administration and Banking study program will be more capable in understanding the fintech world and its impact on society,” concluded Padang.